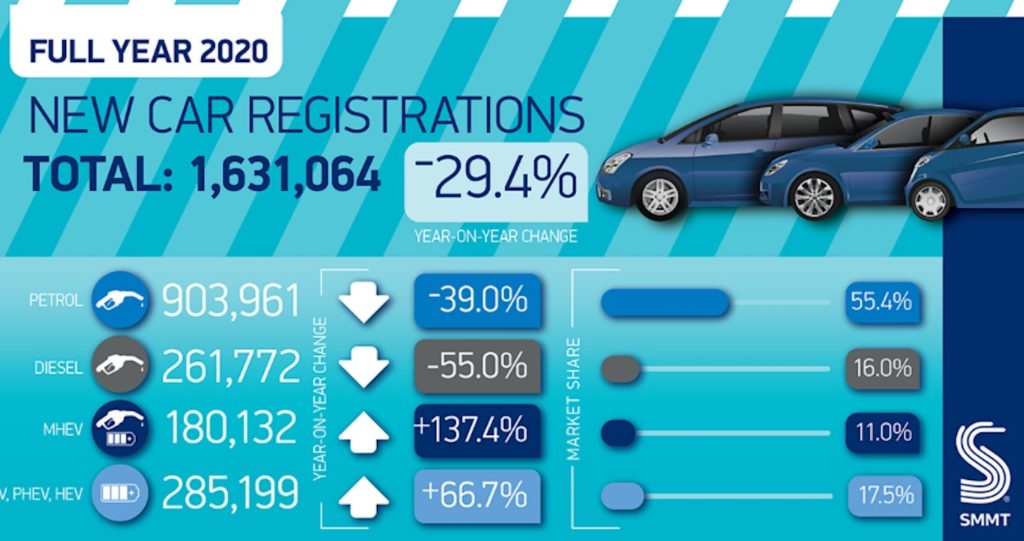

The UK new car market fell by almost a third (-29.4%) in 2020, with annual registrations dropping to 1,631,064 units, according to the Society of Motor Manufacturers and Traders.

A -10.9% decline in December wrapped up a turbulent 12 months, which saw demand fall by 680,076 units to the lowest level of registrations since 1992.

Against a backdrop of Covid restrictions, an acceleration of the end of the sale date for petrol and diesel cars to 2030 and Brexit uncertainty, the industry suffered a total turnover loss of some £20.4 billion, and that has further implications of the Exchequer with lost taxes and duties on sales, fuel and insurance.

Ford remained the best selling brand with 9.37% of sales, but Volkswagen is close on its tail at 9.09% while Mercedes-Benz 6.8% and Audi 6.61% have swept past the likes of Vauxhall 5.85% and Nissan 4.41%.

Looking at the figures there are also signs of pre-registering cars to shift older stock at discounted prices and these will feed into the market over coming months. There is also no annual figure for Tesla, although its December sales were higher than some total 2020 registrations because it fears annual details will impact share prices.

Private vehicle demand fell by -26.6% overall, amounting to a £1.9 billion loss of VAT to the Exchequer. The year saw also saw -31.1% fewer vehicles joining large company car fleets, reflecting the impact of Covid on them.

It was, however, a bumper year for battery and plug-in hybrid electric cars, which together accounted for more than one in 10 registrations – up from around one in 30 in 2019. Demand for battery electric vehicles (BEVs) grew by 185.9% to 108,205 units, while registrations of plug-in hybrids (PHEVs) rose 91.2% to 66,877. Encouragingly, there is room for further growth as most of these registrations (68%) were for company cars, indicating that private buyers need stronger incentives to make the switch, as well as more investment in charging infrastructure, especially public on-street charging.

Looking ahead, another lockdown across England and ongoing tough restrictions across the rest of the UK will further impact the industry and, while click and collect can continue to provide a lifeline, it cannot offset the impact of showroom closures. With a vaccine programme now underway, however, in 2021 there is the potential to drive a recovery that would also support the UK’s environmental goals.

Additionally, with the UK-EU Trade and Cooperation Agreement now in force, the industry has avoided a catastrophic ‘no deal’ scenario and can plan for a future with more certainty over trading conditions. Given seven out of 10 new cars registered in the UK in 2020 were imported from Europe, the continuation of tariff- and quota-free trade is critical to a strong new car market in the UK.

Mike Hawes, SMMT Chief Executive, said, “2020 will be seen as a ‘lost year’ for Automotive, with the sector under pandemic-enforced shutdown for much of the year and uncertainty over future trading conditions taking their toll.

“However, with the rollout of vaccines and clarity over our new relationship with the EU, we must make 2021 a year of recovery. With manufacturers bringing record numbers of electrified vehicles to market over the coming months, we will work with the government to encourage drivers to make the switch, while promoting investment in our globally-renowned manufacturing base – recharging the market, industry and economy.”

The sales picture in 2021 is unlikely to improve, cautions James Fairclough, CEO of AA Cars.

“Unfortunately this week’s announcement of a new national lockdown is likely to hold back sales at the start of this year too,” he said. “With continued uncertainty expected over the coming months, drivers may move away from traditional car ownership in favour of leasing to benefit from greater payment and term flexibility.”

Sean Kemple, MD Close Brothers Motor Finance said there are further hurdles to overcome this year, starting with the latest lockdown and financial losses.

“The surge in demand for electric vehicles is well underway, partially driven by the 2030 ban on new petrol and diesel cars. With the ban expected to shift consumer behaviour, the rise of the environmentally-conscious customer, carmakers releasing new models, and Government incentivisation and taxation, demand for alternative fuelled vehicles (AFVs) will continue to rise,” he said.

Dealers will face the challenges by extending their click and collect services, said Sue Robinson, CEO of the National Franchised Dealers Association.

“Although physical showrooms must remain closed over the coming weeks, franchised dealers have demonstrated their ability to adapt, providing ‘click & collect’ services to customers in a safe and compliant manner. This cannot fully replace the traditional buying experience but will offset some of the issues facing businesses over the coming months.

The market change is likely to see a boost for used-car sellers, said Alex Buttle of on-line seller Motorway. “The used car market is likely to be the main beneficiary of a slow new car market, as buyers look to find more value with their purchases. A higher percentage than normal of buyers upgrading their car in the New Year are likely to look to buy used, even if they haven’t done so before.”

Top ten UK best sellers 2020

Ford Fiesta 49,174

Vauxhall Corsa 46,439

VW Golf 43,109

Ford Focus 39,372

MB A-Class 37,608

Nissan Qashqai 33,972

MINI 31,233

VW Polo 26,965

Ford Puma 26,294

Volvo XC40 25,023

Robin is the longest serving chairman of The Western Group. He's been vice chairman or chairman for over ten years and oversees the annual Western Group PR Driving Day each summer assisted by the group committee and supported by group members.

He contributes to a number of outlets in Wales and the UK, including the Driving Force editorial syndication agency feeding the biggest regional news and feature publishers in Britain.

Robin specialises in the Welsh automotive sector and motor related businesses with interests in Wales and publishes WheelsWithinWales.uk which covers news, features, trade and motor sport in Wales.